Little Known Facts About Pvm Accounting.

Table of ContentsThe 45-Second Trick For Pvm AccountingThe Ultimate Guide To Pvm AccountingThe Best Guide To Pvm AccountingSee This Report about Pvm AccountingThe Ultimate Guide To Pvm AccountingThe 10-Minute Rule for Pvm AccountingOur Pvm Accounting PDFsAll about Pvm Accounting

One of the main factors for executing accountancy in building and construction tasks is the demand for monetary control and monitoring. Building tasks often call for substantial financial investments in labor, products, devices, and other resources. Correct bookkeeping allows stakeholders to monitor and take care of these funds effectively. Accountancy systems provide real-time understandings right into project costs, revenue, and earnings, allowing task supervisors to promptly identify prospective concerns and take rehabilitative actions.

Audit systems enable firms to keep track of capital in real-time, ensuring sufficient funds are available to cover expenses and meet financial responsibilities. Effective money flow administration aids protect against liquidity dilemmas and keeps the job on track. https://padlet.com/leonelcenteno/my-epic-padlet-5wtea3s4b3n04ml4. Construction jobs go through numerous financial mandates and coverage needs. Appropriate accountancy ensures that all financial purchases are taped properly and that the task adheres to accounting standards and contractual agreements.

The Basic Principles Of Pvm Accounting

This minimizes waste and improves task effectiveness. To much better comprehend the relevance of accounting in building and construction, it's likewise crucial to identify in between construction management audit and job management audit.

It concentrates on the monetary facets of private building jobs, such as price evaluation, cost control, budgeting, and cash flow administration for a certain task. Both kinds of accounting are vital, and they enhance each various other. Building monitoring audit ensures the company's economic wellness, while task monitoring accountancy ensures the financial success of private tasks.

The 5-Second Trick For Pvm Accounting

A vital thinker is required, that will deal with others to choose within their locations of duty and to surpass the locations' work procedures. The setting will certainly connect with state, university controller staff, university department team, and academic researchers. This person is expected to be self-directed once the first learning curve is gotten rid of.

The smart Trick of Pvm Accounting That Nobody is Discussing

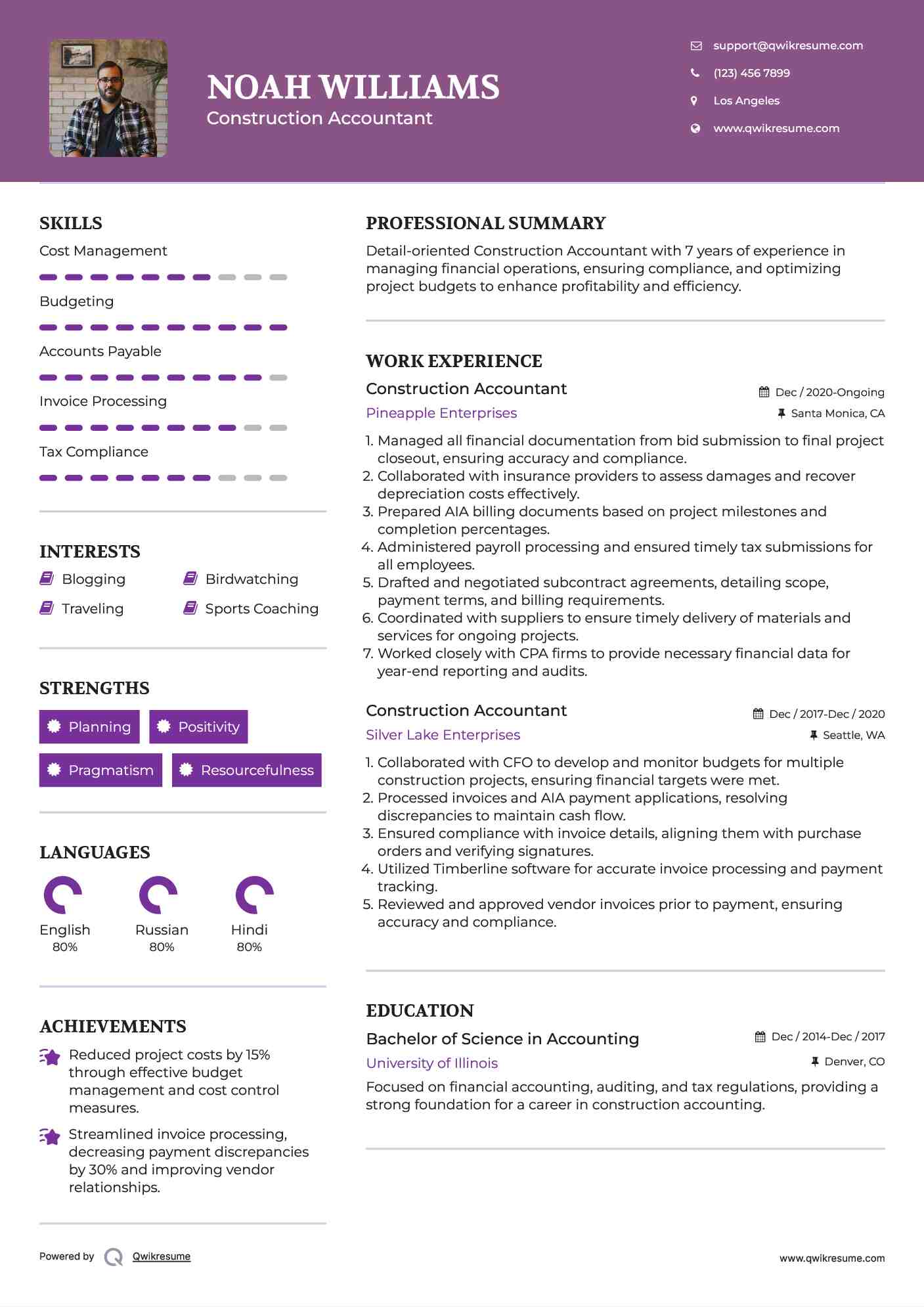

A Building and construction Accounting professional is accountable for managing the monetary elements of building projects, including budgeting, expense tracking, economic reporting, and conformity with regulatory demands. They function closely with task managers, service providers, and stakeholders to ensure accurate monetary documents, cost controls, and prompt repayments. Their expertise in building audit concepts, task setting you back, and financial evaluation is necessary for reliable monetary administration within the building and construction sector.

9 Simple Techniques For Pvm Accounting

Payroll tax obligations are taxes on a worker's gross income. The earnings from pay-roll taxes are utilized to money public programs; as such, the funds accumulated go straight to those programs instead of the Internal Profits Solution (INTERNAL REVENUE SERVICE).

Note that there is an additional 0.9% tax for high-income earnersmarried taxpayers that make over $250,000 or solitary taxpayers transforming $200,000. There is no company suit for this included tax obligation. Federal Joblessness Tax Act (FUTA). Incomes from this tax obligation approach federal and state unemployment funds to assist workers that have actually read this post here shed their tasks.

Things about Pvm Accounting

Your down payments have to be made either on a monthly or semi-weekly schedulean political election you make prior to each fiscal year. Monthly settlements. A regular monthly settlement has to be made by the 15th of the adhering to month. Semi-weekly payments. Every various other week down payment dates depend upon your pay timetable. If your payday drops on a Wednesday, Thursday or Friday, your down payment schedules Wednesday of the following week.

Take treatment of your obligationsand your employeesby making full payroll tax settlements on time. Collection and payment aren't your only tax obligation obligations. You'll likewise have to report these quantities (and other details) consistently to the internal revenue service. For FICA tax (along with federal income tax obligation), you need to finish and file Type 941, Company's Quarterly Federal Tax obligation Return.

Things about Pvm Accounting

States have their very own payroll tax obligations. Every state has its very own joblessness tax (called SUTA or UI). This tax price can vary not only by state however within each state. This is due to the fact that your firm's industry, years in business and joblessness history can all figure out the portion utilized to calculate the amount due.

The Facts About Pvm Accounting Uncovered

The collection, remittance and reporting of state and local-level taxes depend on the governments that levy the taxes. Each entity has its own rules and methods. Clearly, the subject of payroll taxes involves plenty of moving parts and covers a large range of audit understanding. A U.S.-based international CPA can attract on competence in all of these locations when suggesting you on your one-of-a-kind organization configuration.

This website makes use of cookies to improve your experience while you browse through the internet site. Out of these cookies, the cookies that are categorized as required are kept on your browser as they are necessary for the working of basic capabilities of the site. We also make use of third-party cookies that assist us examine and comprehend just how you utilize this web site.